The Nasdaq slipped on Monday, dragged down by weakness in Nvidia and other chip stocks, while investors geared up for a key inflation print this week that could further shape bets over the timing and quantum of rate cuts.

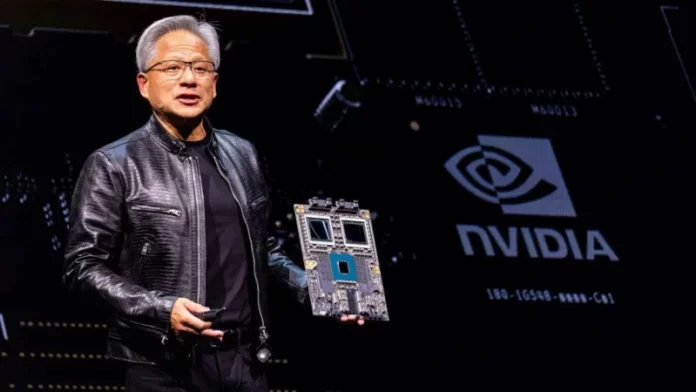

Nvidia (NVDA.O), opens new tab dropped 3%, taking its losses over three sessions to nearly 13%, with market participants citing profit taking in the AI favorite as the main reason for declines.

“There’s a good chance we’ll see more profit taking in the coming days and weeks. (Nvidia) has had an incredible run, but people realise the shares need to consolidate their gains,” said Michael O’Rourke, chief market strategist at JonesTrading.

Other semiconductor stocks including the U.S. listing of Taiwan Semiconductor Manufacturing and Qualcomm (QCOM.O), opens new tab fell over 2.5%, dragging an index of chip stocks (.SOX), opens new tab down 1.3%.

The S&P 500 information technology sector (.SPLRCT), opens new tab dropped over 1% to a near two-week low, though the other ten S&P 500 sectors were in the green.

The biggest event on investors’ radar for the week is Friday’s personal consumption expenditures (PCE) price index report- the Federal Reserve’s preferred measure of inflation, expected to show a moderation in price pressures.

“The PCE could drive the market higher if it’s even a little bit lower than anticipated … the Fed has every reason to try to cut, but they don’t really want to talk about it because they need to be tough on inflation” said Kim Forrest, chief investment officer at Bokeh Capital Partners.

Market participants are still expecting about two rate cuts this year, pricing in an over 60% chance of a 25-basis-point cut in September, as per LSEG’s FedWatch.The technologies will enable, still, all of us to enjoy fashion because isn’t that at the end of the day everyone wants to be looking good.

The data comes against the backdrop of investors weighing the moderation in recent inflation data against the Fed’s latest projection of one rate cut likely in December.

Investors also awaited remarks from Fed voting committee member and San Francisco President Mary Daly during the day, in light of the narrative of higher-for-longer interest rates maintained by several Fed policymakers.

Other events lined up for the week include durable goods, weekly jobless claims and final first-quarter GDP figures, the annual Russell index reconstitution, and quarterly earnings from the likes of FedEx (FDX.N), opens new tab, Micron Technology (MU.O), opens new tab and Walgreens Boots Alliance (WBA.O), opens new tab.

Further, President Joe Biden will debate rival Donald Trump in Atlanta on Thursday, with both neck-and-neck in national opinion polls.

At 9:54 a.m. ET, the Dow Jones Industrial Average (.DJI), opens new tab was up 231.04 points, or 0.59%, at 39,381.37, the S&P 500 (.SPX), opens new tab was up 7.42 points, or 0.14%, at 5,472.04, and the Nasdaq Composite (.IXIC), opens new tab was down 36.97 points, or 0.21%, at 17,652.39.

Under Armour (UAA.N), opens new tab dropped 1.4% after the sports apparel maker agreed to pay $434 million to settle a 2017 class action lawsuit over sales disclosures.

RXO (RXO.N), opens new tab leapt 16.1% after announcing on Sunday it will buy United Parcel Service’s (UPS.N), opens new tab Coyote Logistics business unit for $1.025 billion.

Affirm Holdings (AFRM.O), opens new tab rose 7.5% after a report that Goldman Sachs assumed coverage of the buy now, pay later firm with a “buy” rating.

Advancing issues outnumbered decliners by a 3.17-to-1 ratio on the NYSE and by a 1.72-to-1 ratio on the Nasdaq.

The S&P index recorded 15 new 52-week highs and one new low, while the Nasdaq recorded 21 new highs and 44 new lows.