Hindenburg Research initiated a short position in Icahn Enterprises LP (IEP.O) bonds on Thursday, claiming that the investment business run by billionaire Carl Icahn has failed to resolve every concern identified.

Hindenburg’s new action comes a day after the business posted a surprising loss and said it had been approached by US authorities, but it was unclear whether this was linked to the short seller’s claims made last week.

The short seller said Icahn’s latest disclosures raise critical new questions about margin loans and continued portfolio losses, sending the investment firm’s shares down 4% in premarket trading.

“We are short units of Icahn Enterprises and have initiated a short position in IEP bonds,” Hindenburg said, adding that failure to disclose basic details about the margin loans represent a “near-term critical threat to IEP unitholders”.

The short seller, whose reports on companies have erased a big chunk of their value, had criticized the investment firm for over-reporting its finances and accused it of relying on a “Ponzi-like” structure to pay dividends.

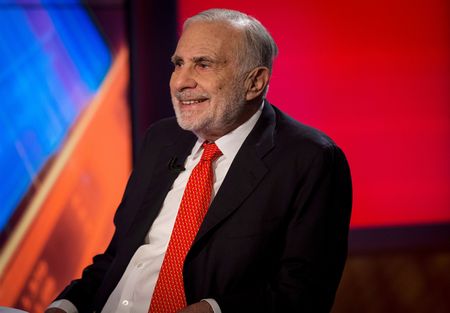

Icahn called the report “self-serving” and vowed to take appropriate steps to “fight back”. Known for his face-offs with industry heavyweights such as AIG (AIG.N) and McDonald’s Corp (MCD.N), the billionaire has never seen his firm become a target of corporate activism.

Icahn owns about 84% of IEP, according to the investment firm’s latest quarterly update. He has pledged about 202.6 million of the depositary units he owns for loans as of May 9.

That was much higher than the 181.4 million units Icahn had pledged earlier.